texas property tax lien loans

For example you could. Why Is a Property Tax Loan a Sound Financial Plan.

Tax Lien Loans 4 Tax Lien Loan Myths And Paying Back Property Taxes In Texas Tax Ease Texas Property Tax Loans

As a statewide alliance of 10 companies we maintain the highest lending standards.

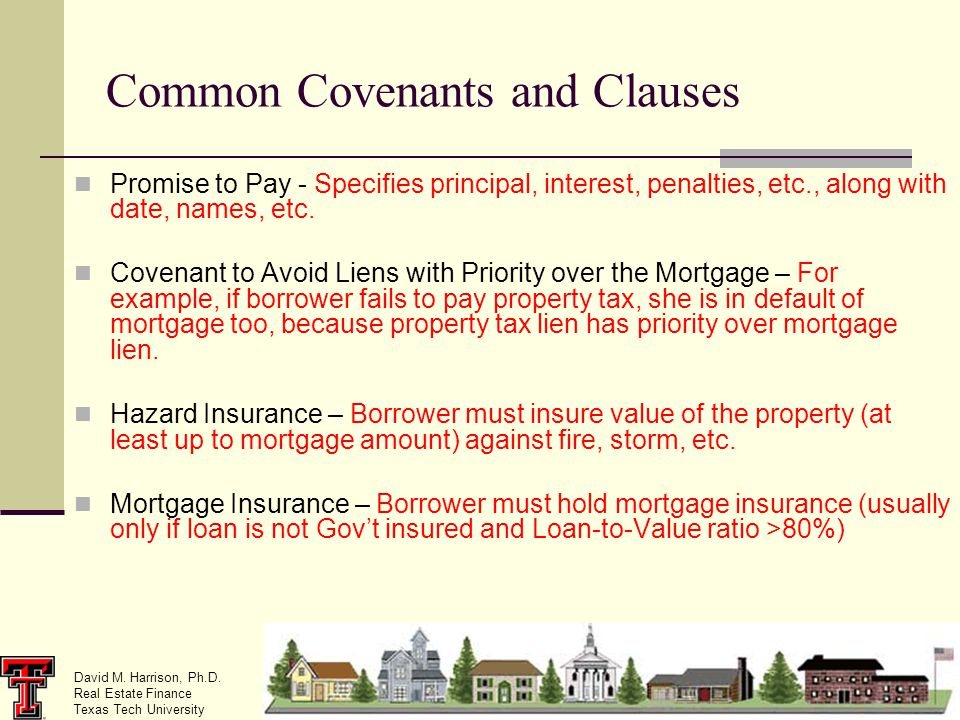

. Tax Ease can offset the burden of penalty fees additional interest and even the chances of losing your home. Property liens are notices that are attached to a piece of real property by a creditor when money is owed to them by the homeowner. Dont let tax lien myths stop you from getting the help you need.

2 Transferee means a person. Funding in as little as 24 hours. Select Popular Legal Forms Packages of Any Category.

Before your taxes are due a tax lien is placed on your property by your taxing jurisdiction. We look forward to helping by offering affordable payment options for your Property Tax Balance. A In this section.

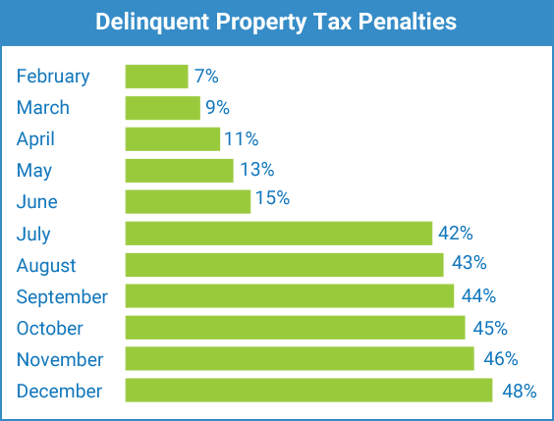

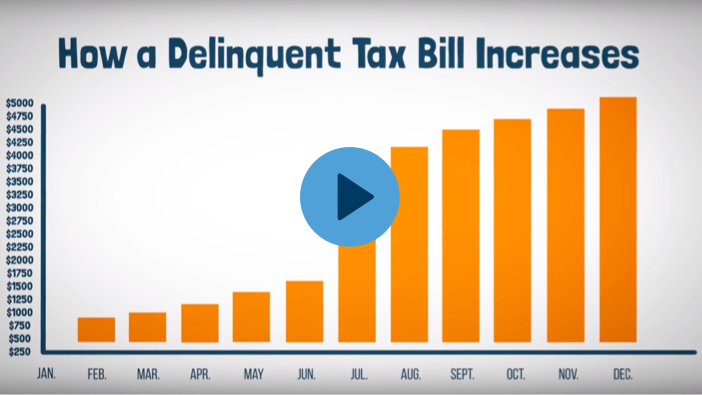

When your taxes go unpaid the tax assessor begins charging interest and penalties that increase. Texas Tax Sale List County by County. Tax Liens List For Properties In And Near Dallas TX How do I check for Tax Liens and how do I buy Tax Liens in Dallas TX.

Buying tax liens at auctions direct or at other sales can turn out to be awesome. Texas Property Tax Lien Loans. HOW TO RELEASE YOUR TAX LIEN.

Paying a bill for property taxes with hefty penalties may be beyond your financial means. Best Loan Options From More Lenders. Melrude MN currently has 1 tax liens available as of November 9.

All Major Categories Covered. The 2021 lien sale was held on December 17 2021. There are several different kinds of property.

We will issue a tax lien release once your Unsecured Property Tax Bill is paid in full. Best Loan Options From More Lenders. There is no tax lien sale scheduled at this time.

Ad Apply now to see options from 75 lenders. Ad Find Tax Lien Property Under Market Value in Texas. Texas Tax Code Section 3206 - Property Tax Loans.

Meet our members 1 2 3 4 A STATEWIDE ALLIANCE OF 10 MEMBER COMPANIES 58 PERCENT OF ALL. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. The most obvious benefit of tax lien investing is the high returns you could get if the property owner pays back the tax debt and the 25 to 50 penalty.

Transfer of Tax Lien Texas Statutes Tax Code Title 1 Subtitle E Chapter 32 Section 3206 Texas Tax Code Sec. 1 Mortgage servicer has the meaning assigned by Section 510001 Property Code. 1 one free copy of the transaction documents at closing.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. When you work with Tax Ease you can make. The Texas Comptrollersoffice manages and files tax liens.

When you have paid off your loan we release the lien by filing a release in the county records. There are more than 1729 tax liens currently on the market. Designs drawings plans plats surveys and specifications done by design professionals are now categorically considered improvements therefore they can be lienable.

Dallas TX currently has 1500 tax liens available as of November. B Notwithstanding Subsection a 11 a property tax lender shall provide a property owner. North Texas Tax Lien Loans is a Licensed Tax Lien Lender who lends Real Property owners.

Funding in as little as 24 hours. A Tax Sale List is the list of Tax Foreclosure Properties properties foreclosed upon due to non-payment of property or county. Search all the latest Texas tax liens available.

Ad Apply now to see options from 75 lenders. Water and sewer liens. Only liens for property taxes and charges were sold.

Loans Up To 500k. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales. Three Easy Steps Application Fill out the form on the right or call us at 866-PROP-TAX and a.

If you have paid your bill in full and have not received your tax lien. Browse Our Collection and Pick the Best Offers. Check Out the Latest Info.

TRANSFER OF TAX LIEN. Loans Up To 500k. The comptrollers office is responsible for keeping track of unpaid taxes and attaching liens to the delinquent property.

Ad Texas property tax lien loans.

Get Rid Of Your Tax Liens In Texas Tax Ease Blog

Benefits Of Texas Property Tax Loans Texas Property Tax Funding

Tptla Texas Property Tax Lienholders Assocation

Texas Property Tax Sales In A Hybrid Tax Deed State Ted Thomas

Property Tax Loans Residential Commercial Lender Propel Tax

Austin Texas Property Tax Loan Provider Austin Property Tax Loans

Texas Tax Lien Transfers Maligned And Misunderstood National Mortgage News

Can I Sell Property With A Tax Lien

Can I Get A Mortgage If I Owe Federal Tax Debt To The Irs

Notice Under Rule 736 For Order For Foreclosure Of Ad Valorem Tax Lien November 10 2011 Trellis

5 17 2 Federal Tax Liens Internal Revenue Service

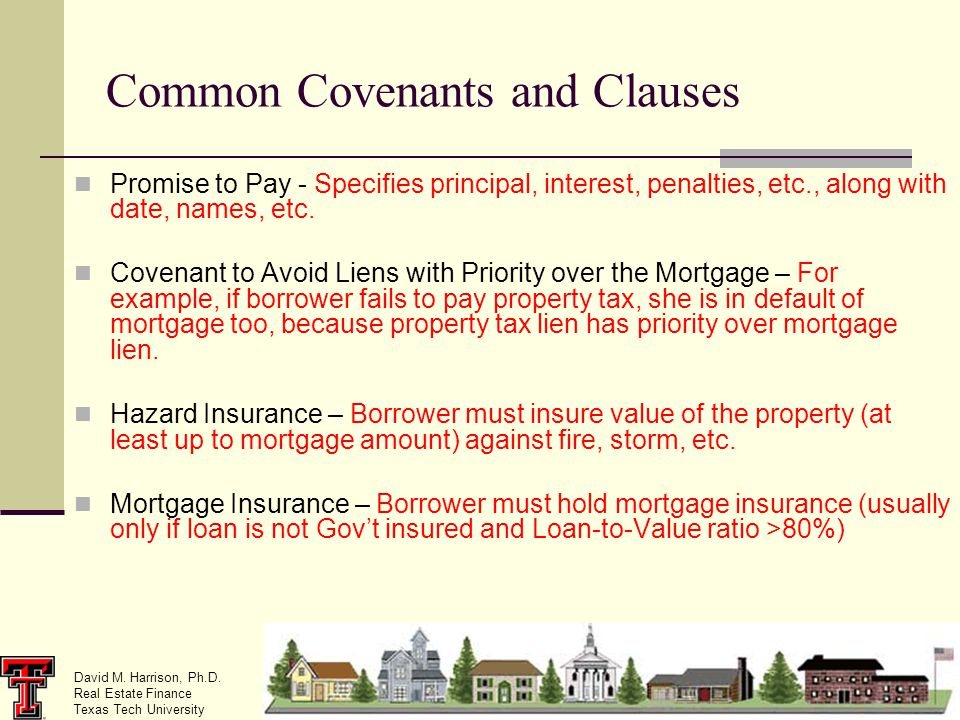

David M Harrison Ph D Real Estate Finance Texas Tech University Common Covenants And Clauses Promise To Pay Specifies Principal Interest Penalties Ppt Download

![]()

Texas Property Tax Loans 1 Property Tax Lender

Texas Property Tax Loans Commercial Residential Propel Tax

Teacher Home Loans Down Payment Assistance Mortgage Tax Credits Texas State Affordable Housing Corporation Tsahc